Wolfram Corporate Finance Professional Assistant

The Wolfram Corporate Finance Professional Assistant is an essential tool for professionals and students in the finance field. Whether you are making investment decisions, trading futures, or involved in other financial transactions, this app will have every calculation you need.

Topics include:

Definitions for over 40 terms.

Time-Value of Money

- Annuities calculations: solve for present value, future value, interest rate, compounding periods, periodic payments, and perpetuities.

- Lump Sums: solve for PV, FV, simple interest, and more.

- Nominal and effective rate conversions.

- Amortization: compute initial loan amount, payment amount or breakdown, interest rate, and number of periods.

Equity Valuation

- Discounted cash flow analysis.

- Use the Capital Asset Pricing Model (CAPM) to solve for the expected return, beta coefficient, risk-free interest rate, and return on market.

- Use the Dividend Discount Model (DDM) to solve for the stock value, discount rate, dividend growth rate, and initial dividend amount.

- Use the Benjamin Graham formula to solve for the intrinsic value, earnings per share, long-term earnings growth estimate, and current yield AAA corporate bonds.

- Use the relative graham value to solve for the current price and intrinsic value.

Fixed Income

- Determine accrued interest.

- Bond pricing calculations: general price, yield to maturity, face value, coupon rate, and redemption value--all including clean and dirty price calculations.

- Bond duration: annual coupon rate and yield to maturity calculations--including both Macaulay and Modified durations.

- Treasury bills, certificate of deposits, bond calendar calculations, discounted security, interest at maturity security.

Capital Budgeting

- Discrete and continuous capital recovery factor and interest rate.

- Compounding and interest periods.

- Internal rate of return, profitability index, and depreciation

- Weighted cost of capital: cost of equity and debt, tax rate, total equity and debt.

Retirement Budgeting

- Simple Investment: use portfolio style and return & risk to solve for ending value, ongoing yearly investment, and accumulation period.

- Calculate the portfolio value for investment planning using the ongoing yearly withdrawal or the withdrawal percent.

- Pension computations.

VaR, Options, and Hedging

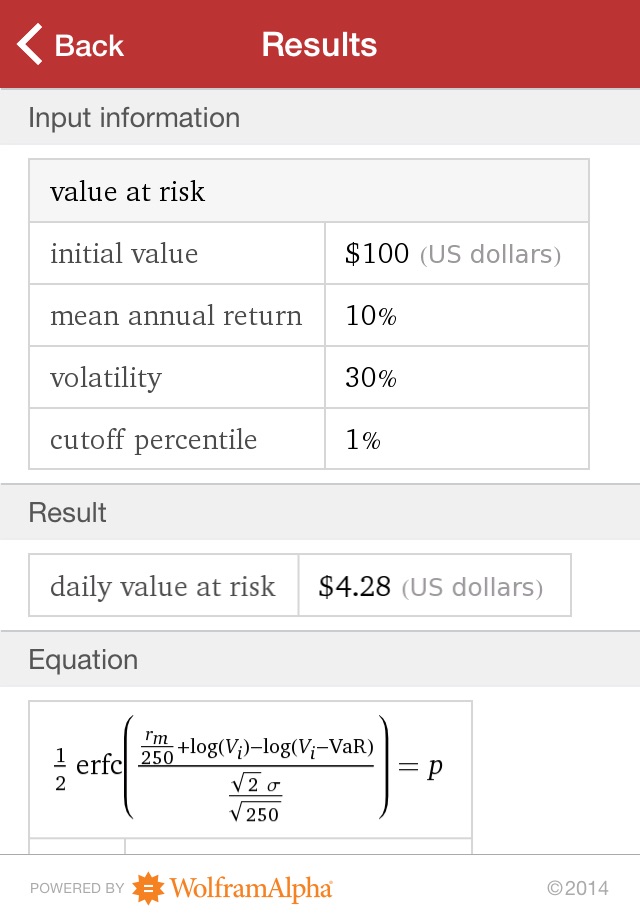

- Use the value at risk, log-normal distribution to solve for the value at risk, mean annual return, annual volatility, and cutoff percentile.

- Evaluate various options: Vanilla Option, Covered Call Option, Protective Put Option.

- Hedging Calculations: stock and commodity contracts, duration-based hedge ratio, minimum variance hedge, and hedge effectiveness.

Market Quotes

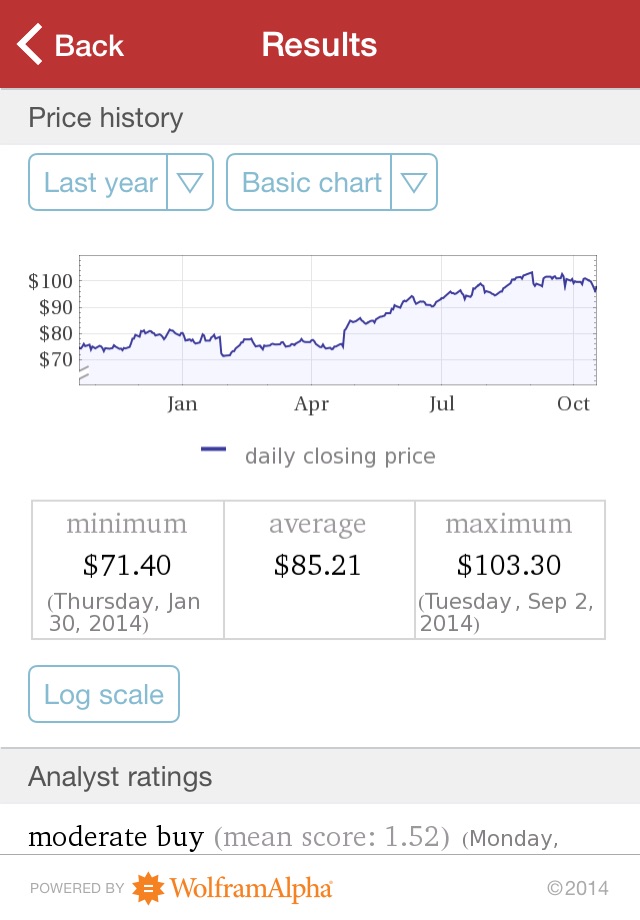

- Get up-to-date information on stocks, funds, and indices.

- Currency conversions.

- Futures contracts for stock indices, metals, energy sources, agricultural and other commodities, foreign exchanges, and interest rates

Interest and Tax Rates

- Compare US state income tax rates and compute marginal US tax rates.

- Calculate current interest rates on credit cards, mortgages, LIBOR rates, personal loans, and more.

Cost of Living

- Use the relocation calculator to compute and compare costs of living such as housing, groceries, utilities, and salary.

- Look up the current US and international Consumer Price Indices (CPI) and US inflation rates.

Get salary and minimum wage data by state, college expenses, and gas prices.

The Wolfram Corporate Finance Professional Assistant is powered by the Wolfram|Alpha computational knowledge engine and is created by Wolfram Research, makers of Mathematica—the worlds leading software system for mathematical research and education.

The Wolfram Corporate Finance Professional Assistant draws on the computational power of Wolfram|Alphas supercomputers over a 3G, 4G, or Wi-Fi connection.